Anúncios

Understanding financial tools available to workers in Brazil can be a game-changer for achieving long-term stability and independence.

Among these tools, workers’ credit stands out as a powerful resource, offering both accessibility and numerous benefits. But what exactly is workers’ credit, who qualifies for it, and how can it be effectively utilized?

Anúncios

This comprehensive guide will break down everything you need to know about workers’ credit in Brazil. From eligibility criteria and key benefits to a step-by-step explanation of how it works, we’ll provide clear insights to help you make informed financial decisions.

Whether you’re looking to manage debt, fund an important purchase, or simply gain more control over your finances, this guide is designed to show how workers’ credit can fit into your strategy for financial freedom.

Anúncios

With rising interest in accessible financial solutions, understanding the intricacies of this type of credit is more relevant than ever.

By the end of this guide, you’ll have a clear roadmap to assess whether workers’ credit aligns with your needs and how to leverage it to your advantage.

Understanding Workers’ Credit: What It Is and Who Can Benefit

What Exactly Is Workers’ Credit in Brazil?

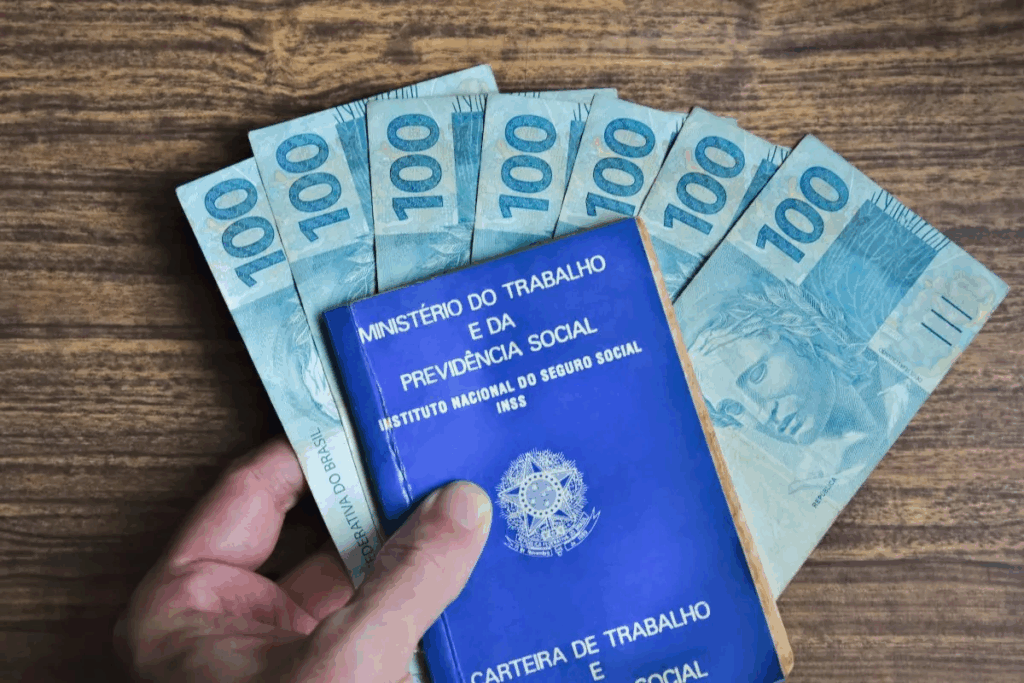

Workers’ credit, known in Portuguese as “crédito consignado”, is a financial product specifically designed for employees, retirees, and other eligible individuals in Brazil. This type of credit is unique because it offers lower interest rates compared to traditional loans, as payments are automatically deducted from the borrower’s payroll or pension.

This automatic deduction minimizes risks for financial institutions, which is why these loans come with more favorable terms for workers.

The purpose of workers’ credit is to provide financial relief or opportunities to individuals who may need to consolidate debts, cover emergencies, or fund personal projects, all while avoiding the higher interest rates associated with traditional loans or credit cards. For many Brazilians, this credit line acts as a safety net, helping them navigate financial challenges with more stability.

Given its accessibility and lower cost, workers’ credit is an important tool for promoting financial well-being. However, it’s not available to everyone. Understanding who qualifies and how it works is the first step to leveraging this benefit effectively.

Who Is Eligible for Workers’ Credit?

Eligibility for workers’ credit varies depending on the institution offering the loan, but generally, it is available to the following groups:

- Public Sector Employees: Government workers often have easier access to workers’ credit, as their income is considered stable and reliable.

- Private Sector Employees: Employees with formal work contracts registered under Brazil’s Consolidation of Labor Laws (CLT) can also apply. However, their eligibility often depends on agreements between their employer and the financial institution.

- Retirees and Pensioners: Individuals receiving benefits from the National Institute of Social Security (INSS) are a significant portion of workers’ credit borrowers.

- Military Personnel: Members of the armed forces typically qualify due to their consistent income and job security.

If you’re uncertain about your eligibility, it’s always worth checking with your employer or directly with a financial institution that offers workers’ credit. Each lender may have specific requirements or partnerships that could impact your access.

The Key Benefits of Workers’ Credit

Lower Interest Rates Compared to Other Loan Types

One of the most significant advantages of workers’ credit is its affordability. Because repayments are deducted directly from your salary or pension, lenders face a reduced risk of default. This allows them to offer loans with interest rates that are often much lower than those of personal loans or credit cards.

To put this into perspective, while credit card interest rates in Brazil can exceed 300% annually, the average rate for workers’ credit tends to range between 20% and 40% per year.

This substantial difference can mean significant savings over time, especially for borrowers looking to consolidate existing debts.

For individuals who are trying to regain control over their financial situation, these lower rates provide a much-needed lifeline. The savings on interest can be redirected toward other goals, such as building an emergency fund or investing in education.

Fixed Monthly Payments for Better Financial Planning

Another benefit of workers’ credit is its predictability. With fixed monthly installments deducted directly from your paycheck or pension, it’s easier to budget and plan your finances. You won’t have to worry about missing payments or facing penalties, as the system is designed to ensure on-time repayment.

This structure is particularly helpful for individuals who are new to managing loans or who have struggled with repayment in the past. By removing the burden of manual payments, workers’ credit simplifies the financial process and helps borrowers stay on track.

Moreover, because the repayment terms are agreed upon in advance, you’ll know exactly how much is being deducted each month and for how long. This transparency allows for better long-term financial planning, giving you more control over your future.

How to Apply for Workers’ Credit in Brazil

Steps to Get Started

Applying for workers’ credit in Brazil is a straightforward process, but it’s important to follow the correct steps to ensure you get the best possible terms. Here’s a step-by-step guide to help you navigate the application process:

- Verify Your Eligibility: Before applying, confirm that you meet the eligibility requirements. Check with your employer, pension provider, or the financial institution offering the loan.

- Compare Lenders: Different banks and credit unions offer workers’ credit, each with varying interest rates, fees, and terms. Take the time to compare options to find the most favorable conditions.

- Gather Required Documents: Typically, you’ll need your identification (CPF and RG), proof of income, and proof of employment or pension. Some lenders may require additional documentation.

- Submit Your Application: Once you’ve chosen a lender, complete their application process. This may involve an online form, a visit to a branch, or both.

- Review the Terms Carefully: Before signing any agreements, read the contract thoroughly. Pay close attention to the interest rate, loan term, and any additional fees.

- Approval and Disbursement: If your application is approved, the loan amount will be deposited directly into your bank account. Repayments will begin according to the agreed-upon schedule.

Taking these steps can help you avoid common pitfalls and ensure that your experience with workers’ credit is a positive one.

Tips for Maximizing the Benefits of Workers’ Credit

To make the most of your workers’ credit, consider the following tips:

- Borrow Only What You Need: While it may be tempting to take out a larger loan, remember that you’ll need to repay it with interest. Borrow only what is necessary to meet your immediate needs.

- Pay Attention to Loan Terms: Shorter repayment periods can save you money on interest, but they also result in higher monthly payments. Find a balance that works for your budget.

- Avoid Multiple Loans: Taking out multiple loans simultaneously can lead to financial strain. Focus on repaying one loan before considering another.

- Seek Professional Advice: If you’re unsure about your financial options, consider consulting a financial advisor. They can provide personalized guidance based on your situation.

By approaching workers’ credit thoughtfully, you can use it as a tool to enhance your financial stability and achieve your goals.

Common Questions and Misconceptions About Workers’ Credit

Is Workers’ Credit Risky?

Some people worry that workers’ credit might lead to financial difficulties, especially if they take on more debt than they can handle. While it’s true that any form of borrowing carries risks, workers’ credit is generally safer than other loan types due to its lower interest rates and fixed repayment terms.

The key to minimizing risk is understanding your budget and borrowing within your means. If you’re unsure how much you can afford to borrow, use online calculators or consult with a financial advisor before committing to a loan.

Can I Use Workers’ Credit for Anything?

Yes, workers’ credit is typically unrestricted, meaning you can use the funds for a variety of purposes. Common uses include paying off high-interest debt, covering medical expenses, funding education, or making home improvements. However, it’s essential to use the loan responsibly and prioritize needs over wants.

Ultimately, workers’ credit can be a powerful financial tool when used wisely. By understanding its benefits, eligibility requirements, and application process, you can make informed decisions that support your financial health and long-term goals.

Conclusion: Unlocking Financial Freedom with Workers’ Credit in Brazil

In conclusion, workers’ credit, or “crédito consignado”, is a powerful financial tool designed to provide stability and accessibility for eligible Brazilians.

With its lower interest rates, fixed repayment terms, and streamlined deduction system, this loan type offers a unique opportunity to address financial needs without falling into the pitfalls of high-interest alternatives like credit cards or traditional personal loans.

By understanding its benefits and eligibility criteria, borrowers can make more informed decisions and take proactive steps toward achieving financial freedom.

This form of credit is particularly advantageous for individuals seeking to consolidate debts, handle emergencies, or fund essential projects.

With clear steps to apply and practical tips to maximize its benefits—such as borrowing only what is necessary and carefully reviewing loan terms—workers’ credit serves as a reliable lifeline for both short-term relief and long-term planning. However, like any financial product, responsible use is key.

Borrowers should always consider their budget, avoid overextending themselves, and seek professional advice if needed to make the most of this opportunity.

Ultimately, workers’ credit embodies the potential for financial empowerment, offering a pathway to greater security and well-being for millions of Brazilians. By leveraging this resource wisely, individuals can unlock a brighter and more stable financial future.