Anúncios

Understanding workers’ consigned loans in Brazil can be the key to unlocking financial stability and freedom.

With some of the lowest interest rates available in the market, this type of credit is specifically designed to make borrowing more accessible for employees and retirees.

Anúncios

But navigating the details—eligibility requirements, how to apply effectively, and avoiding common debt pitfalls—is essential to maximize its benefits.

In this guide, discover how consigned loans work, who qualifies, and why they are a popular option for those looking for a reliable financial solution. Learn practical tips to streamline the application process, minimize risks, and maintain healthy financial habits.

Anúncios

Whether you’re seeking to consolidate debt, cover unexpected expenses, or fund a personal project, understanding this loan option could provide the financial flexibility you need.

Stay informed, avoid costly mistakes, and take control of your finances with actionable insights tailored to the Brazilian market. This is your complete roadmap to making smart financial decisions through consigned credit solutions.

Understanding Workers’ Consigned Loans: A Financial Solution Tailored for Employees

What Are Workers’ Consigned Loans?

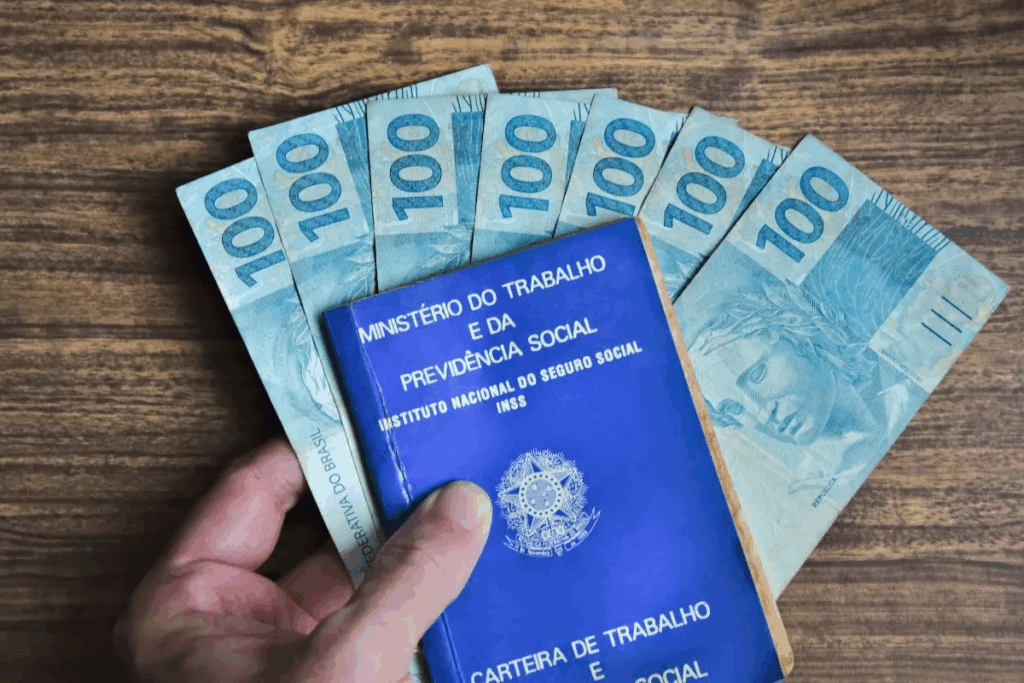

Workers’ consigned loans, known in Portuguese as crédito consignado, are a type of credit facility widely available in Brazil. This form of loan is unique in that repayments are directly deducted from the borrower’s salary or pension.

It is a financial product specifically designed for formally employed individuals, public servants, and retirees, offering a low-risk and low-interest credit option compared to traditional personal loans.

Because the repayments are guaranteed through automatic payroll deductions, lenders perceive this loan as having minimal default risk. As a result, the interest rates for consigned loans are considerably lower than those of credit cards or unsecured personal loans.

This makes it a financially attractive solution for individuals seeking quick access to credit while maintaining manageable repayment terms.

The loan amounts vary depending on the borrower’s monthly income and the portion of their salary that can legally be committed to repayments, which is referred to as the margin consignável. Typically, borrowers can allocate up to 30% of their income for loan repayments, ensuring they retain sufficient funds for other expenses.

Who Is Eligible for Workers’ Consigned Loans?

To qualify for a consigned loan in Brazil, borrowers must meet specific eligibility requirements. These criteria generally include:

- Being a formally employed worker with a registered contract (CLT), a public servant, or a retiree/pensioner under the INSS (Brazilian National Social Security Institute).

- Having a consistent and verifiable source of income, as the loan repayments are directly linked to monthly earnings or pensions.

- Availability within the borrower’s margin consignável, which is the maximum portion of income legally allowed for payroll deductions related to loans.

Employers also play a role in facilitating consigned loans. Many companies have agreements with banks or financial institutions, enabling employees to access this type of credit more easily. For public sector workers and pensioners, government bodies or INSS partnerships ensure access to favorable loan conditions.

However, it’s important to note that self-employed individuals or informal workers typically do not qualify for this type of loan, as they lack the formal payroll structure required for automatic deductions. For such individuals, other credit options need to be explored.

Advantages of Workers’ Consigned Loans: Why Choose This Option?

Low Interest Rates: A Game-Changer for Borrowers

One of the most appealing aspects of workers’ consigned loans is their competitive interest rates. Compared to conventional personal loans or credit cards, the interest rates for consigned loans are significantly lower. While traditional personal loans in Brazil may have interest rates exceeding 50% per year, consigned loans typically range between 15% and 30% annually, depending on the lender and the borrower’s profile.

This affordability makes consigned loans an ideal choice for individuals looking to consolidate debt, finance personal projects, or cover unexpected expenses without falling into the high-cost debt trap. The automatic deduction mechanism reduces the risk for lenders, which translates into cost savings for borrowers.

Flexible Loan Amounts and Terms

Workers’ consigned loans offer flexibility in both loan amounts and repayment terms. Borrowers can access credit based on their income and available margin, with repayment periods often ranging from 12 to 96 months. This allows individuals to choose a term that best fits their financial situation, balancing monthly payment amounts with the total cost of the loan.

Additionally, lenders often provide quick approval processes for consigned loans, as the risk of non-payment is minimal. In many cases, the funds are deposited into the borrower’s account within a few days, making it a convenient option for those in need of urgent financial assistance.

How to Apply for a Workers’ Consigned Loan: A Step-by-Step Guide

Step 1: Check Your Eligibility

Before applying for a consigned loan, it’s essential to verify whether you meet the eligibility criteria. Confirm that you are a formal worker, public servant, or retiree with a consistent income and that your employer or pension provider has agreements with financial institutions offering consigned loans.

Additionally, calculate your margin consignável to determine the maximum loan amount you can access. This ensures you do not overextend your finances or apply for a loan exceeding the legal deduction limit.

Step 2: Compare Lenders and Interest Rates

Not all consigned loans are created equal, and interest rates can vary significantly between lenders. Take the time to research and compare offers from different banks or financial institutions. Look for transparent terms, competitive rates, and additional benefits, such as reduced fees or flexible repayment terms.

Many online platforms allow you to simulate loans and compare options from various providers. This can save time and help you make an informed decision.

Step 3: Submit Your Application

Once you’ve selected a lender, gather the necessary documentation, which typically includes proof of income, identification documents, and, in some cases, a statement from your employer or pension provider. Submit your application through the lender’s branch, online portal, or mobile app, depending on the institution’s process.

After submission, the lender will evaluate your application and may request additional documents or information. Upon approval, the funds will be disbursed directly to your account, often within a few business days.

Preventing Debt: Responsible Use of Consigned Loans

Understanding the Risks

While workers’ consigned loans offer numerous benefits, it’s crucial to use them responsibly to avoid potential financial pitfalls. The ease of access and lower interest rates can sometimes lead borrowers to take on more debt than they can comfortably manage. Overextending your margin consignável may leave you with insufficient funds for daily expenses or emergencies.

Additionally, it’s important to consider the long-term impact of multiple consigned loans. Each new loan reduces your available margin, potentially limiting your financial flexibility in the future. Borrowers should carefully evaluate whether they truly need a loan and ensure it aligns with their financial goals and capacity.

Practical Tips for Responsible Borrowing

To make the most of your consigned loan without falling into debt traps, consider the following tips:

- Borrow only what you need: Avoid taking out larger loans simply because you qualify for them.

- Understand your repayment capacity: Calculate your monthly expenses and ensure you can comfortably manage loan repayments within your budget.

- Keep track of your margin consignável: Avoid maxing out your payroll deduction capacity to maintain financial flexibility.

- Use the loan for productive purposes: Prioritize using consigned loans for essential or income-generating purposes, such as paying off high-interest debts or funding education.

By following these guidelines, you can unlock the financial freedom offered by workers’ consigned loans while maintaining control over your finances.

Conclusion: Empower Your Financial Journey with Workers’ Consigned Loans

Workers’ consigned loans represent a powerful financial tool for employees, public servants, and retirees in Brazil, offering a balance of accessibility, affordability, and flexibility.

With low interest rates and automatic payroll deductions, this loan option reduces financial stress while ensuring manageable repayment terms. By utilizing these loans responsibly, borrowers can address immediate financial needs, consolidate debt, or invest in personal projects without falling into high-interest traps.

To unlock the full potential of consigned loans, it’s essential to take a strategic approach. Start by verifying your eligibility and understanding your margin consignável.

Then, research and compare lenders to find competitive rates and favorable terms that match your financial needs. This careful preparation ensures you avoid overborrowing and maintain long-term financial health. Additionally, always prioritize using loans for essential purposes, such as paying off high-cost debts or achieving goals that improve your financial future.

While consigned loans offer significant advantages, they require a responsible borrowing mindset to prevent overindebtedness. By staying informed, budgeting wisely, and adhering to the practical tips outlined in this guide, you can confidently take control of your finances.

Ultimately, workers’ consigned loans can serve as a gateway to financial freedom, empowering you to meet your goals with stability and security.